Your Complete Roadmap to Purchasing Property in North Carolina

Thinking about becoming a homeowner in the Tar Heel State? Let's walk through every stage of the journey so you know exactly what to expect.

Purchasing property is one of the biggest financial decisions most people will ever make. In North Carolina, the process has its own unique characteristics that set it apart from other states. From the Triangle region's bustling tech-driven market to the coastal communities and mountain retreats, understanding how to navigate each phase will save you time, money, and stress.

This guide breaks down the entire experience into manageable phases, whether you're stepping into homeownership for the first time or you've been through this before.

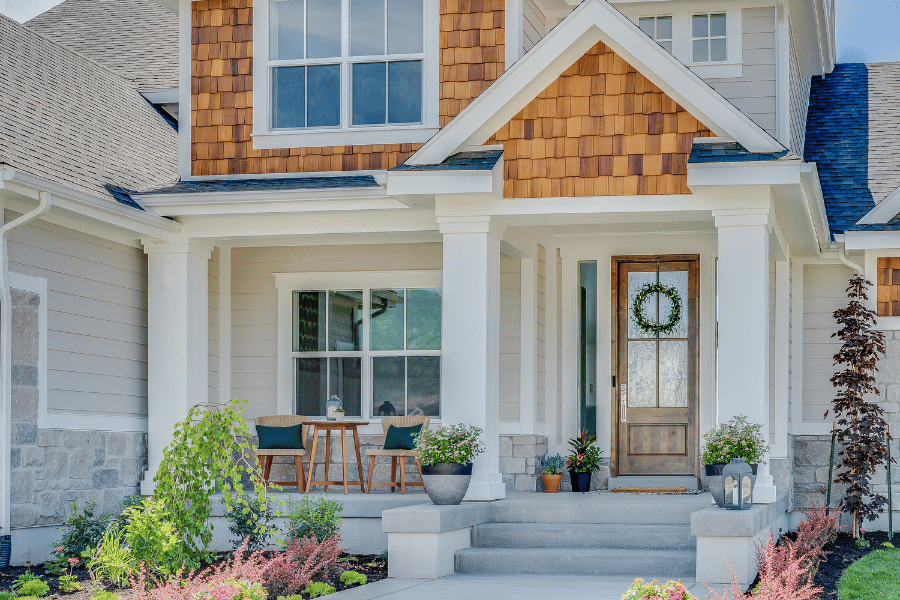

Phase 1: Define Your Ideal Property

Before you even glance at listings, take time to honestly assess what matters most in your future residence. It's easy to get swept up in fantasy features, but staying grounded will serve you better.

Start by separating non-negotiables from preferences. Non-negotiables might include the number of bedrooms needed for your family or a maximum commute distance to work. Preferences could include things like a swimming pool or a particular architectural style.

Property Considerations

Land and space: Do you envision yourself on several acres with room to breathe, or are you comfortable with a smaller lot near neighbors? Does parking matter? Would a condo suit your lifestyle better than a standalone house?

Geographic preferences: Think about whether urban energy, suburban tranquility, or rural seclusion appeals to you most. Proximity to employment hubs like Research Triangle Park or downtown areas may factor into your decision.

Interior requirements: Beyond bedroom count, consider bathrooms, whether you want single-story living, and features like a finished basement.

Education quality: For families with children, Wake County and Chapel Hill-Carrboro offer particularly strong public school systems worth researching.

Phase 2: Secure Mortgage Pre-Approval

There's an important distinction between pre-qualification and pre-approval. Pre-qualification gives you a rough estimate. Pre-approval involves a thorough credit check and financial review, giving you a concrete figure for how much you can borrow.

In competitive markets—especially areas like the Triangle—pre-approval signals to sellers that you're a qualified, committed buyer. It also prevents heartbreak from falling in love with properties beyond your means.

North Carolina Financing Options

- NC Housing Finance Agency programs: First-time purchasers may qualify for down payment help and favorable terms

- USDA Rural Development loans: Designed for properties in qualifying rural zones throughout the state

- VA loans: Popular near military installations like Fort Bragg and Camp Lejeune

- Flood insurance considerations: Certain properties, particularly near the coast, may require additional coverage that affects monthly payments

Prepare your financial documents in advance—tax returns, pay stubs, bank statements, and debt information. Shopping among multiple lenders can reveal rate differences that translate to significant savings over your loan's lifetime.

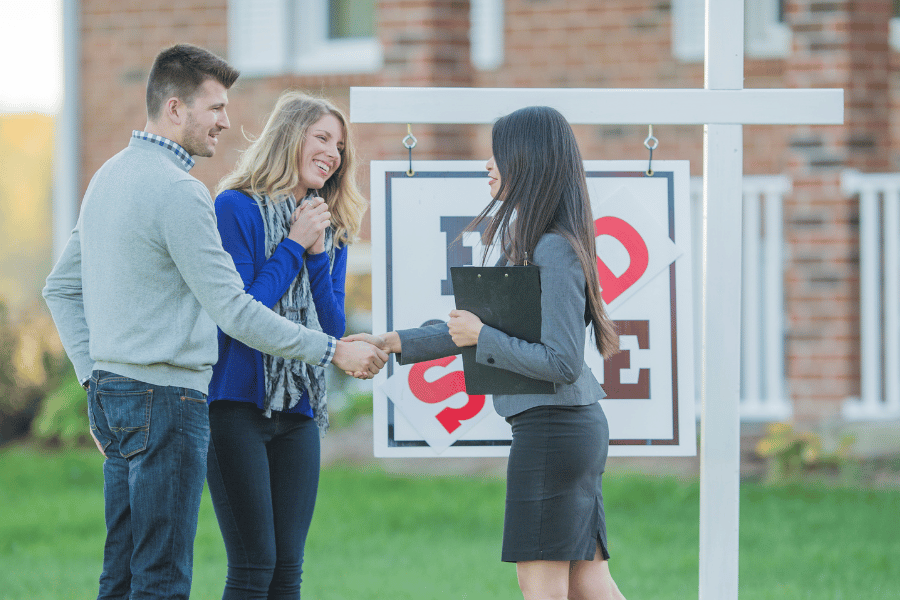

Phase 3: Partner With a Knowledgeable Agent

Working with someone who understands North Carolina's varied market conditions—seasonal fluctuations, development patterns in growing communities, and the influence of the tech sector on housing demand—makes an enormous difference.

The good news? Buyers typically don't pay agent commissions directly. Sellers generally cover these costs, usually around 5-6% of the sale price split between buyer and seller agents.

Do your homework before committing. Ask people you trust for recommendations. Review online testimonials. Browse potential agents' websites and social media presence. Conduct interviews with multiple candidates—it's completely normal and expected.

You'll spend considerable time with this person over the coming weeks or months, so compatibility matters. Ask plenty of questions and trust your instincts about whether the relationship feels right.

Phase 4: Hunt for the Right Property

Now comes the exciting part. With your budget set and your agent ready, you can explore what's available.

Smart Search Tactics

- Explore neighborhoods firsthand: Visit areas at various times—morning rush hour, evening, weekends—to understand the real feel of a community

- Attend open houses and schedule private viewings: Photos never tell the whole story; experiencing spaces in person reveals details about layout, condition, and neighborhood context

- Consider newly built options: Communities in Morrisville, Fuquay-Varina, Wendell, and other expanding areas offer modern construction

Keep organized notes and photographs of each property you visit. North Carolina's geographic variety means you might compare vastly different options—from urban condos to sprawling rural estates—making systematic tracking essential.

Phase 5: Submit Your Offer

Found something that feels right? Time to put together a compelling proposal.

Your agent will analyze comparable recent sales in the area. If similar homes have sold for less than the asking price, that informs your strategy. If the market is hot and properties move fast, you may need to be more aggressive.

Building a Strong Proposal

- Pricing strategy: Base your offer on solid market data, not emotion

- Earnest money deposit: Usually 1-3% of the purchase price, held in escrow to demonstrate serious intent

- Protective contingencies: Inspection, appraisal, and financing clauses shield you from unforeseen problems

- Timeline: Standard North Carolina contracts typically allow 10-14 days for due diligence

Phase 6: Navigate Negotiations

Rarely does the first offer get accepted as-is. Expect some back-and-forth. This might take several days—or longer—as both sides work toward mutually acceptable terms.

Patience and professionalism go a long way. Stay courteous with everyone involved: your agent, the seller's agent, and the sellers themselves. Remember that your agent is advocating for your interests throughout.

Phase 7: Conduct Thorough Inspections

Once your offer is accepted, North Carolina law grants a due diligence window—typically 10-14 days—to investigate the property thoroughly. Use this time wisely.

A professional inspector will examine the structure, electrical systems, plumbing, roof, and more. The cost falls on you as the buyer, but this investment can prevent costly surprises down the road.

Complete the inspection before ordering the appraisal or finalizing financing. If significant issues emerge, you retain the option to walk away or renegotiate.

State-Specific Inspection Factors

- Termite examination: Nearly always required by lenders given the climate

- Foundation assessment: Clay-heavy soil in many regions can cause structural concerns

- Climate control systems: Crucial given hot, humid summers and variable winters

- Code compliance: Older properties may need electrical or plumbing updates

- Radon screening: Advisable in certain areas

- Septic evaluation: Essential for properties not connected to municipal sewer

Phase 8: Finalize Your Financing

Assuming the inspection goes well, you'll move forward with your lender to complete the mortgage process.

Credit scores above 620, stable income, and larger down payments typically qualify for conventional loans. Those with lower scores, smaller down payments, or limited income might explore government-backed options.

Lenders require a property appraisal to confirm the home's value matches the loan amount. Appraisers examine recent nearby sales to make this determination.

Mortgage Process Checkpoints

- Complete application submission: Provide all requested financial documentation

- Appraisal order: Lender arranges professional property valuation

- Underwriting review: Comprehensive examination of your file leading to approval decision

- Rate lock: Secure your interest rate against market movement

- Clear-to-close: Final approval to proceed

Maintain close contact with your lender during this phase. Avoid major financial changes—new credit accounts, large purchases, employment changes—that could jeopardize approval.

Phase 9: Secure Title Protection

Title insurance safeguards your ownership rights and is typically mandatory for lenders. This process involves researching the property's ownership history to ensure you receive clear, uncontested title.

Most North Carolina counties require attorney-supervised closings. Your closing attorney typically coordinates title insurance and resolves any complications that surface.

Title Insurance Components

- Historical research: Professional review of public records verifying ownership chain

- Title commitment: Document specifying coverage and any exceptions

- Owner's policy: Protects your equity interest (optional but wise)

- Lender's policy: Protects the mortgage holder's interest (mandatory)

- Potential issues: Outstanding liens, easements, boundary disputes, inheritance complications

Phase 10: Perform Your Final Walkthrough

Within 24-48 hours before closing, you'll visit the property one last time. This is your opportunity to confirm everything is as expected before taking ownership.

Walkthrough Verification List

- Repair confirmation: Ensure all negotiated fixes were properly completed

- System testing: Run HVAC, check electrical outlets, test plumbing and appliances

- Included items: Verify agreed-upon personal property remains

- Issue documentation: Photograph any new problems

- Utility verification: Confirm electricity, water, gas, and other services work

If you discover significant problems, address them immediately with your agent. Minor issues might be resolved through closing credits. Major problems could delay the transaction.

Phase 11: Close the Deal

The final step. In North Carolina, attorneys conduct closings, guiding you through document signing and fund transfers.

Closing Day Checklist

- Document explanation: Attorney walks you through the deed, mortgage note, and settlement statement

- Fund preparation: Bring certified funds for down payment and closing costs

- Signature session: Sign mortgage documents, deed, and other required paperwork

- Key handover: Receive keys and official ownership transfers to you

- Recording: Documents are filed with the county register of deeds

Common Questions

What happens at closing?

You (or your lender) provide payment for the amount owed. The seller signs the deed, officially transferring ownership to you.

Can I move in immediately after closing?

Your contract specifies the exact possession date. Sometimes you receive keys at the closing table. Other times, sellers may have negotiated 30, 45, or 60 days of continued occupancy after closing.

Who pays transfer taxes in North Carolina?

Sellers typically cover this. North Carolina imposes $1 per $500 of the sale price. For a $300,000 property, that's $600.

How long does closing take?

Plan for one to two hours if everything proceeds smoothly. Complications can extend this significantly.

Wrapping Up

Navigating property purchases in North Carolina means understanding state-specific regulations, local market dynamics, and regional nuances that shape your experience.

Whether the vibrant downtown scene appeals to you, family-oriented suburban communities catch your eye, or you're drawn to the state's beautiful rural landscapes, following these phases systematically will help you reach your goal of homeownership with confidence.